Each Sunday I sit down to reflect on the events of the past week and plan out my trading for the coming week. I write the newsletter partly for myself, in order to organize my thinking, and partly for the benefit of readers whose questions and comments have given me a sense of which areas I should emphasize and drill down on.

From the outset I have considered the core of the newsletter to be a discussion of the main influences on the market during the past week, an evaluation of the most important economic data and earnings report scheduled for the coming week and a discussion of my current investment thesis and trading ideas across a broad range of asset classes, sectors, geographies, etc.

As time went on, reader feedback has caused me to place increased emphasis on volatility, including the VIX, various other volatility indices, VIX futures, VIX options and the growing number of VIX ETFs and VIX ETNs. As a result of this feedback, it has been the Volatility Corner section of the newsletter that has seen the most growth in terms of dedicated space and analysis. This trend continued during the fourth quarter, when as a result of the proliferation of volatility-based ETNs and ETFs I expanded the Volatility Update table to include data and analysis of three new VIX ETNs:

- TVIX -- VelocityShares Daily 2X VIX Short-Term ETN

- XIV -- VelocityShares Daily Inverse VIX Short-Term ETN

- XVIX -- UBS E-TRACS Daily Long-Short VIX ETN

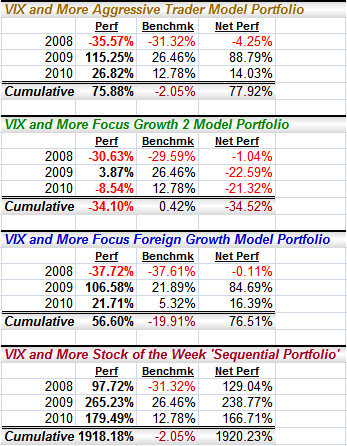

Of course, each quarter I publish performance data for three model portfolios and a Stock of the Week ‘Sequential Portfolio’ (SOTW). During the fourth quarter the model portfolios performed extremely well, racking up substantial gains. Three of the four portfolios topped their benchmarks during the quarter, some of them by huge margins. The sole exception was Focus Foreign Growth, which still managed to top its benchmark (the EAFE index ETF, EFA) by more than 16% for the year.

The one disappointment for 2010 was the Focus Growth 2. As detailed in the post below, I decided to revamp both the stock selection rules as well as the position management algorithms for Growth 2 and implemented those changes on August 30. Since that change, Growth 2 is up 30.8% and is making up ground on the benchmark S&P 500 index.

This brings me to the Stock of the Week ‘Sequential Portfolio’ (SOTW), which has become a rock star of sorts. After returning 97% in 2008 (from the March 30th launch until the end of the year, the SOTW gained 265% in 2009 and followed that up with a gain of 179% in 2010. As I am sure the publication of the numbers for the full year will once again bring in a rash of emails, let me offer up some pre-emptive commentary.

First, I recommend that anyone who is interested in exploring the SOTW in some detail examine the work of Michael Stokes of MarketSci, who had a three-part series in April 2010 in which he reviewed the SOTW, first as a single stock portfolio, then using a short SPY position to hedge market risk and finally examining a theoretical 10-week holding period. The quick summary of MarketSci’s findings is that the performance of the SOTW was very strong both unhedged and hedged, but there is not convincing evidence of persistent outperformance past the initial post-selection week.

The full set of MarketSci reviews can be found at:

- Review of the VIX & More Stock of the Week

- Hedging the VIX & More Stock of the Week – uses a short SPY position to hedge market risk, with impressive results

- Holding V&M’s Stock of the Week for Longer than a Week – looks at a 10-week holding period and does not find persistent outperformance past the initial post-selection week

“This is different from the Friday close to Friday close data I have always reported in my subscriber newsletter, because I always wanted to report a cost basis in the newsletter on Sunday and assumed that if I avoided stocks which had news over the weekend, the difference between using a Friday close vs. a Monday open as a cost basis would not be meaningful in the long run.”Many readers have asked me to provide an analysis of how the SOTW would have performed in 2010 had someone used the SOTW selections to purchase the SOTW at its opening price on the following Monday and sell it at its closing price at the end of the week. I hope to have this information and some additional related analysis published in short order.

For those seeking additional information, I am offering a 14-day free trial (see top of right column) to the subscriber newsletter for all new subscribers.

Disclosure(s): long XIV and short VXX at time of writing