It has been almost four years since I have updated here what I have been doing with the VIX and More subscriber newsletter. Given all the craziness we have witnessed in the markets this year, this seems like a good time to let potential subscribers know what to expect with the current version of the newsletter, which was launched over twelve years ago on March 29, 2008 and has undergone quite a few tweaks along the way, with most of the changes driven by subscriber feedback.

In its current incarnation, the newsletter averages 12-13

pages and averages about one chart or graphic per page. The newsletter is emailed to subscribers

every Wednesday and has a relatively fixed format, with the following sections:

Market Commentary – I begin each newsletter with a recap of a half dozen or so of what I consider to be the key events of the week. Here the focus is largely on fundamentals and ranges from geopolitical events to the actions and words of central banks across the globe to economic data or COVID-19 developments or whatever forces are behind the movements in the financial markets. I will almost always tie in changes in interest rates, commodities, volatility and stocks. [Includes a graphic of the SPX and VIX]

Volatility Overview – Over time, the newsletter has slowly migrated from a publication that highlighted events in the volatility world and offered analysis and trading ideas to something where volatility, the VIX product space and options are central to the entire narrative. Here one will find an analysis of what happened in the volatility universe during the week, trends in implied vs. realized volatility, as well as notable changes in volatility across various geographies and asset classes, the VIX ETP space, tail risk, buy-writes, etc. [Includes multiple graphics comparing the VIX to SPX historical volatility as well as a table of 25 key elements in the volatility landscape]

VIX Futures Term Structure – In addition to explaining past and future movements in the VIX ETPs, the VIX futures term structure highlights upcoming event risk, changes in how investors perceive structural/systemic volatility, seasonal factors and other anomalies. [Includes one graphic of the VIX futures term structure vs. the past one or two weeks as well as a plot of the relative levels of each VIX futures contract]

Trading Volatility and the Short Vol Index – This section begins by explaining the statistical likelihood that the short-term (e.g., VXX) and mid-term (e.g. VXZ) volatility ETPs will rise or fall in the next two week (the proprietary Short Vol Index), then moves on to a longitudinal study of various options trade ideas published in previous weeks. These options trade ideas encompass volatility, U.S. and international equities, sectors, geographies, commodities, fixed income and a wide variety of narrowly focused ETPs. Options trade ideas include spreads, straddles, strangles, backspreads, ratios, synthetic options, condors, butterflies, etc. The discussion includes new weekly trade ideas and management of existing open trade ideas. [Typically, there are one or two tables used to monitor open trade ideas, with performance and other relevant data]

Risk Assessment: Evaluating Relative Risk and Volatility in Asset Classes, Geographies and Sectors – This may be my favorite section to write each week, as it is typically full of insights not easily discoverable elsewhere. The data comes from an analysis of the relative risk and uncertainty in 75 groups of asset classes, geographies and sectors. The top five groups with the highest relative risk score as well as the top five groups with the biggest positive change in relative risk over the course of the past week are highlighted, with a brief analysis of the factors that are responsible for elevated relative risk. Here the hope is to identify everything from areas where risk is overpriced to areas where risk is beginning to trend upward, perhaps as part of an early warning signal. [Includes one table each for the top five areas of relative risk as well as the top five weekly increases in relative risk]

The Fed – Here I assess the consensus expectations related to the evolution of Fed policy as well as my interpretation of where the Fed is going and why it may diverge from consensus expectations. I also delve into various speeches and interviews during the week and the implications for changes in Fed policy going forward. For Fed policy statements and press conferences, the Wednesday publication provides an opportunity for a timely summary and analysis of critical developments that arise from the eight annual FOMC meetings. [The graphic in this section range from the expected evolution of the fed funds rate to Summary of Economic Projections, aka the “dot plots”]

Featured Chart(s) and Commentary – Each week I include 2-4 charts that highlight subjects I consider to be key themes or data trends in the economy or in areas that are likely to impact the economy and financial markets. The subject matter ranges from fundamental trends to economic data to market sentiment to political factors or subjects such as COVID-19 data. Many of the charts make use proprietary indices and research. Typically, these graphics are key inputs into the next section of the newsletter…

Current Investment Thesis – In many respects, this section is the synthesis of all the sections above. Here I summarize my short-term tactical thinking about the financial markets as well as offer up an intermediate-term or sometimes long-term perspective on where I believe things are going. I touch on what is driving my investment thesis, what key milestones lie ahead and how I am positioning myself to take advantage of those opportunities. I endeavor to make this a make this a wide-ranging investment thesis, incorporating equities, volatility, commodities, fixed income and ETPs from across the asset class spectrum. I almost always delve into geographies, sectors and factors as well. While my focus is generally on growth and speculative opportunities, depending upon the state of the markets, I typically also discuss some hedging ideas as well as some income-oriented trade ideas.

Featured ETP Trade Ideas – New as of June 2019 is a section where I highlight three ETPs, indicate whether a long or short bias makes sense over the course of the next 1-4 week options cycle and briefly summarize my rationale for each trade idea. I also track performance of these ETP trade ideas in rolling one, two, three and four-week portfolios and I am delighted by the performance of these trade ideas in the first thirteen months since I began publishing this information in this section. [Includes a performance graphic for rolling one, two, three and four-week portfolios]

For those seeking additional information on the newsletter, I am offering a 14-day free trial (see top of right column) to the subscriber newsletter for all new subscribers.

[Additionally, for those who may be interested exclusively in trading VIX ETPs, my VIX and More EVALS (ETP Volatility Analysis Long-Short) model portfolio service is certainly worth investigating.]

Related posts:

- VIX

and More Newsletter Update as of January 2017

- Newsletter

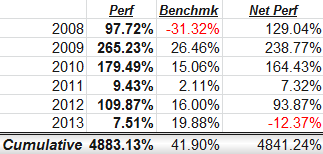

Update, Stock of the Week Performance Data and the Launch of New

Investment Management Business

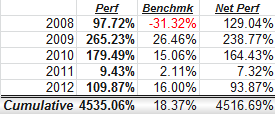

- Q4

2012 Newsletter Update, with Stock of the Week +109% for 2012 and +4535%

Since Inception

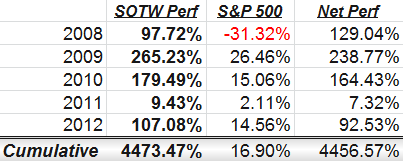

- Q3

2012 Newsletter Update, with Stock of the Week +107% YTD and +4473 Since

Inception

- Changes

to Newsletter Place More Emphasis on VIX Exchange-Traded Products

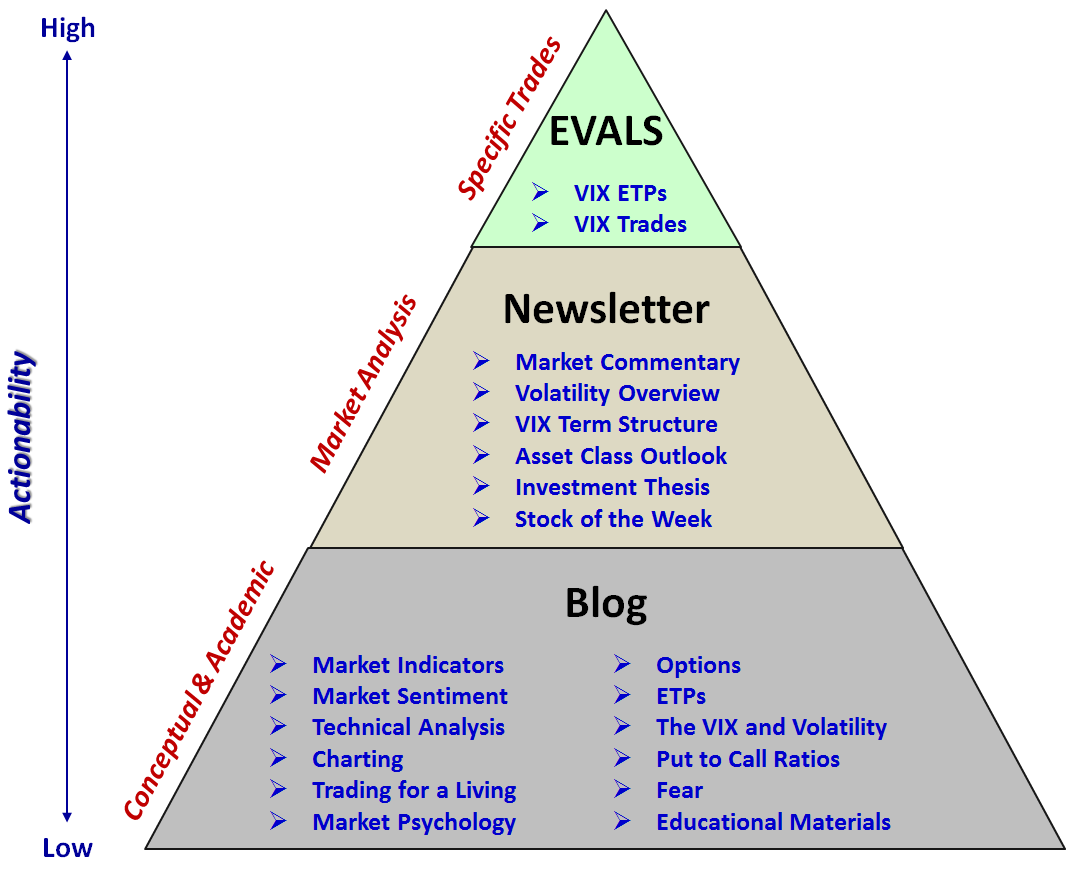

- Highlighting

Newsletter Content Focus with Content Pyramid

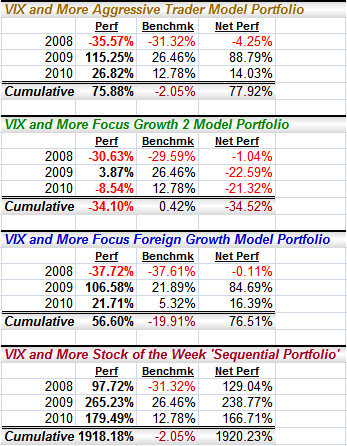

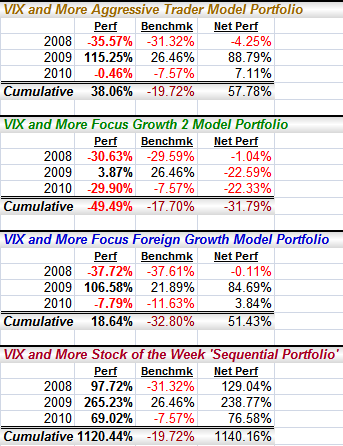

- Newsletter and Portfolio Performance Update Through 12/31/10

Disclosure(s): net short VXX at time of writing