I offered a fairly thorough update of the VIX and More Newsletter about three months ago in my Q3 2012 Newsletter Update, which discussed some of the changes in content and in format that occurred during 2012. In that post, I spent a fair amount of time addressing the refocusing of emphasis on the analysis and trading the VIX ETPs. Since the primary interest of many newsletter subscribers is trading products like VXX, XIV, UVXY, TVIX, etc., I thought I should talk a little more about four proprietary indices that I chart and discuss each week and that are essential to many of my VIX ETP trading strategies:

- Roll Yield Index

- Contango Index

- Mean Reversion Index

- +XIV Index

These first three of these indices evaluate the shape of the overall VIX futures term structure and the roll yield at the front end of the curve, then compare these to a VIX prediction model I developed which attempts to anticipate the probability of an upward or downward move in the VIX over the course of the next week, weighted by the potential magnitude of that move. The final index uses the data from the first three indices to evaluate the advisability of being long either XIV or VXX based on the VIX futures term structure and the VIX prediction model for the coming week. The process may seem somewhat complex, but the results have been excellent and after they become familiar with the approach, many subscribers tell me that this Trading Volatility section quickly becomes their favorite part of the newsletter.

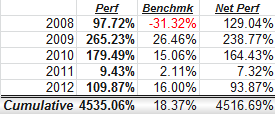

Another perennial newsletter favorite is the Stock of the Week ‘Sequential Portfolio’ (SOTW) that I update each week. In the Q3 2012 Newsletter Update, I offered more details about the stock selection process than I ever have before and I encourage readers who are interested in the mechanics of my SOTW stock selection approach to click on the link above and review what I had to say. Now that 2012 is officially in the books, I can report that the SOTW gained 109.87% in 2012 and ended the year with a cumulative return from the March 30, 2008 inception of +4335%, handily topping the 18.4% return by the S&P 500 index during the same period.

One quirky ‘feature’ of the SOTW performance accounting is that in order to make my record-keeping easier, I have historically used the closing price of the evening the newsletter is published as my cost basis for the SOTW. While this means subscribers who wished to buy at the open on the following morning would rarely have the same cost basis, I have maintained that over the long run, as long as I steer clear of stocks with after-hours news (which I do), any performance differential between using the Wednesday closing price or the Thursday opening price (or Thursday’s VWAP or Thursday’s close or whatever) should not be meaningful. In order to test that theory with 2012 data, I recalculated the SOTW performance for 2012 using the next day’s opening price and determined that the SOTW would have returned 106.19% with that calculation methodology. On 28 of the 52 weeks, the SOTW opened higher on the day following the newsletter than it closed on the day the newsletter was published. Given that the S&P 500 index was up 16% for the year, a slight upside bias is not surprising. The largest close to open price variances were found in CSTR, which appreciated 2.6% by the time it opened the next day, while MVG was down 2.0% when it first traded following the publication of the newsletter.

Also, please note that I am using more and more large capitalization and mega-cap stocks in the SOTW. In the fourth quarter, some of the selections were JPM, F, YHOO, IBN, etc. Some of the third quarter SOTW selections were MRK, AMGN, GILD, BBT, VLO, RF, HFC, TSO, etc.

Going forward, analyzing volatility as well as trading VIX ETPs and other volatility-centric products will continue to be the main focus of the newsletter. That being said, I will also discuss trading opportunities across all types of asset classes, weigh in on geopolitical and macroeconomic issues and provide a broad-based framework for structuring a portfolio to take advantage of the opportunities these present.

For those seeking additional information on the newsletter, I am still offering a 14-day free trial (see top of right column) to the subscriber newsletter for all new subscribers. Additionally, for those who may be interested exclusively in trading VIX ETPs, my VIX and More EVALS (ETP Volatility Analysis Long-Short) model portfolio service is certainly worth investigating.

Related posts:

- Q3 2012 Newsletter Update, with Stock of the Week +107% YTD and +4473 Since Inception

- Changes to Newsletter Place More Emphasis on VIX Exchange-Traded Products

- Highlighting Newsletter Content Focus with Content Pyramid

- Newsletter and Portfolio Performance Update Through 12/31/10 (includes a discussion of the Stock of the Week)

1 comment:

Are you scared to look at Stock newsletter? Do you want to learn the secrets of winning stock picks? Have you been Swing trading picks eager to learn how to trade stocks from a long time? Here is your chance to canslim stock picks fulfill your dreams.

Post a Comment